In 2025, investors are increasingly looking beyond traditional stock investments to build and protect their wealth. Relying solely on stocks can be risky due to market volatility. Diversification is key to managing risk and potentially enhancing returns.

This article explores alternative investments that can complement a traditional stock portfolio. From real estate and bonds to cryptocurrencies and collectibles, various options are available for those looking to diversify. As economic conditions create unique opportunities in alternative investments, it’s essential to conduct thorough research and due diligence.

With new platforms making alternative investments more accessible, diversification beyond stocks is no longer just for wealthy investors. This shift is opening up new avenues for a broader range of investors to manage their portfolio and potentially grow their wealth.

Why Diversification Beyond Stocks Matters in 2025

With market volatility on the rise, investors in 2025 are seeking robust diversification strategies to safeguard their portfolios. The concept of diversification is rooted in Modern Portfolio Theory (MPT), introduced by economist Harry Markowitz in the 1950s. This theory posits that a well-diversified portfolio can optimize returns while minimizing volatility by avoiding overconcentration in any single asset class.

The Limitations of Stock-Only Portfolios

Relying solely on stocks can expose investors to unnecessary market volatility and risk, especially in the uncertain economic climate of 2025. Stock-only portfolios are vulnerable to market downturns, industry-specific disruptions, and macroeconomic factors that can significantly impact returns. For instance, during the 2008 financial crisis, diversified portfolios fared better than those heavily invested in stocks.

| Asset Class | 2008 Performance | Average Annual Return |

|---|---|---|

| Stocks | -38.5% | 8% |

| Bonds | 5.2% | 4% |

| Real Estate | -18.7% | 6% |

The Modern Portfolio Theory Approach

Modern Portfolio Theory provides a framework for understanding the benefits of diversification across different asset classes. By strategically balancing different types of investments, investors can reduce risk exposure and improve long-term stability. The key is to find assets with low correlation, ensuring that when one asset class underperforms, others can compensate.

Historically, properly diversified portfolios have shown more stable returns with lower volatility compared to concentrated stock portfolios. As the economic conditions of 2025 make diversification particularly important, investors should consider a strategy that includes a mix of asset classes to protect and grow their wealth.

Real Estate: The Tangible Alternative Investment

Beyond the stock market, real estate investments offer a unique blend of income generation, capital appreciation, and diversification benefits. As one of the best investments besides stocks, real estate opportunities span both passive and active avenues for generating wealth.

Rental Properties: Becoming a Landlord

Investing in rental properties allows investors to earn a consistent cash flow through tenant payments and potential property appreciation. Becoming a landlord can be lucrative, but it also involves management responsibilities and potential risk.

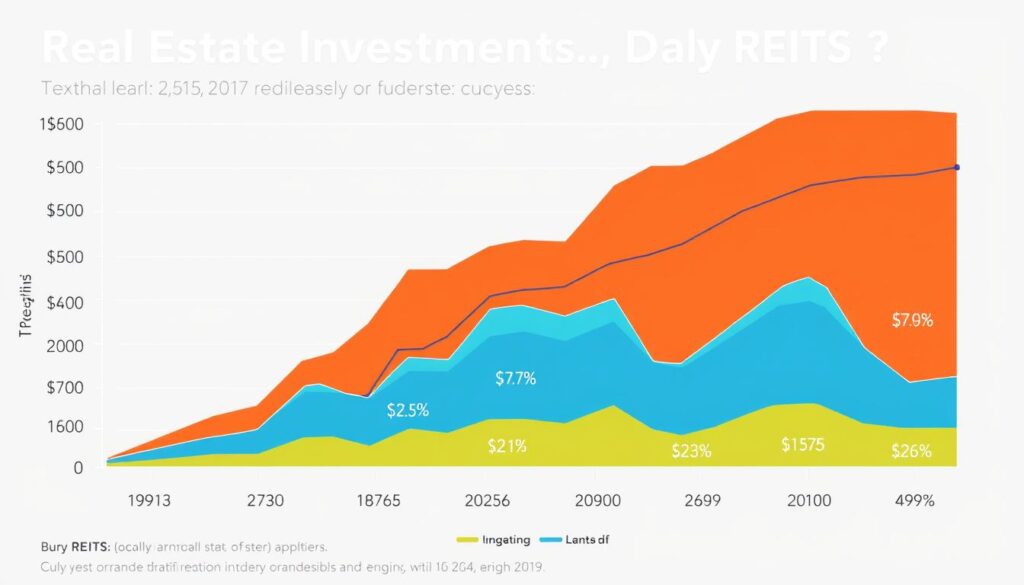

REITs: Real Estate Without the Hassle

REITs, or Real Estate Investment Trusts, are publicly traded companies that own, manage, or finance income-generating real estate. They facilitate exposure to estate investments without the need for direct property ownership, making them accessible to investors with varying levels of capital.

Real Estate Crowdfunding Platforms

Real estate crowdfunding is a non-traditional investment option that grants access to real estate investments without the need for large capital. Online platforms allow investors to pool their money to finance residential or commercial developments, potentially earning attractive returns.

Different real estate investment options can serve different purposes in a diversified portfolio, from income generation to inflation hedging. By understanding the benefits and challenges of each, investors can make informed decisions that align with their financial goals and risk tolerance.

Bonds and Fixed-Income Securities in a Rising Rate Environment

With interest rates on the rise, bonds and fixed-income securities are gaining traction among investors seeking lower-risk investments.

Bonds present a lower-risk investment alternative with fixed returns. Among the most stable investments other than stocks, fixed-income securities produce predictable returns through interest payments and lower volatility than equities.

Government Bonds: A Safe Haven

Government bonds are considered low-risk investments, as they are backed by national governments and have consistent interest payments. Investors can buy government bonds directly through Treasury websites or via brokerage accounts.

Corporate Bonds: Balancing Yield and Risk

Corporate bonds provide higher yield than government bonds but come with varying risk levels depending on the issuing company’s financial health. Investors should assess the credit ratings of corporate bonds to make informed decisions.

Municipal Bonds: Tax Advantages

Municipal bonds, issued by local governments, offer tax advantages while funding essential infrastructure projects. These bonds can be particularly valuable for investors in higher tax brackets, providing tax-exempt income.

In conclusion, bonds and fixed-income securities can provide stability and income in a portfolio, particularly in a rising interest rate environment. By understanding the characteristics of different types of bonds, investors can make informed decisions to achieve their financial goals.

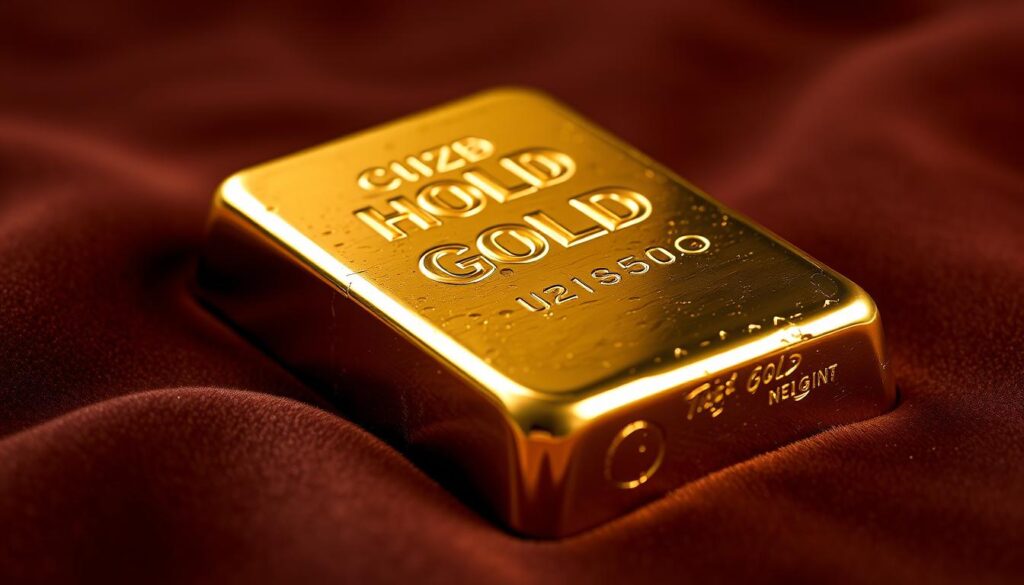

Precious Metals: The Time-Tested Hedge Against Uncertainty

As economic instability looms, the allure of precious metals as a safe-haven asset grows. Investors have long recognized the value of gold, silver, and other precious metals in hedging against inflation, market volatility, and economic downturns.

Precious metals assure a reliable hedge against economic uncertainty. Gold and silver bullion, in particular, are physical assets that retain value over time, making them a popular choice for investors seeking to safeguard their wealth.

Physical Gold and Silver: Owning the Real Thing

Investors purchase gold and silver bars or coins as a store of wealth, particularly during times of economic instability. While bullion is a stable asset, it requires secure storage and may come with additional costs for safekeeping.

Mining Stocks: Indirect Exposure to Metals

Mining stocks give investors indirect exposure to gold and precious metals by investing in companies that extract and refine these resources. This approach introduces additional factors such as company management and operational efficiency.

Gold ETFs and Derivatives: Easier Access Points

Gold ETFs and derivatives provide exposure to gold prices without the need for physical ownership, offering a more accessible way to gain exposure to precious metal price movements.

In conclusion, precious metals offer a time-tested hedge against economic uncertainty, inflation, and market volatility. By understanding the different investment vehicles available, investors can make informed decisions about incorporating precious metals into their diversified portfolios.

ETFs Beyond the Standard Index

ETFs have revolutionized the investment landscape by providing access to specific sectors, strategies, and global markets. This shift has enabled investors to diversify their portfolios more effectively, moving beyond traditional index funds to achieve their financial goals.

Sector-Specific ETFs for Targeted Growth

Sector-specific ETFs allow investors to capitalize on the growth potential of particular industries. For instance, technology-focused ETFs have been top performers in recent years, driven by innovation and demand for tech services. Investors can gain exposure to emerging trends without the risk associated with individual stocks.

Dividend ETFs for Passive Income Generation

Dividend ETFs are designed for investors seeking regular income. These funds invest in stocks with a history of consistent dividend payments, offering a relatively stable source of returns. By focusing on dividend-paying companies, investors can generate passive income while still benefiting from potential capital appreciation.

Global ETFs for International Exposure

Global ETFs provide investors with the opportunity to diversify their portfolios geographically. By investing in ETFs that track international markets, investors can tap into the growth potential of emerging and developed economies outside their home country. This can help mitigate domestic market risks and capitalize on global economic trends.

To conclude, ETFs beyond the standard index offer a versatile toolkit for investors. By incorporating sector-specific, dividend, and global ETFs into their portfolios, investors can achieve a more nuanced and diversified investment strategy. It’s essential to evaluate the quality of ETFs based on factors like expense ratios, tracking error, and liquidity.

Cryptocurrency and Digital Assets: Beyond the Hype

As we dive into the world of alternative investments, cryptocurrency and digital assets stand out as a fascinating and rapidly growing space. The rapid growth of digital assets has introduced new investment opportunities, resulting in cryptocurrency investments becoming one of the most exciting non-traditional investment options available today.

Understanding Bitcoin and Major Altcoins

Bitcoin, the first and most well-known cryptocurrency, has paved the way for thousands of alternative digital currencies (altcoins). For those wondering how to safely invest in cryptocurrency, understanding the fundamental concepts behind Bitcoin and major altcoins is crucial. These digital currencies have the potential to act as “digital gold” or innovative payment systems, offering a new paradigm for investors.

Crypto Staking and Yield Farming

Crypto staking allows investors to earn passive income by locking up their cryptocurrency investments in a blockchain network to support operations like transaction validation. On the other hand, yield farming enables investors to earn additional rewards by lending or providing liquidity to DeFi platforms. Both methods come with their own set of risks and potential returns, making it essential for investors to understand the intricacies involved.

Blockchain ETFs: A New Investment Avenue

For investors seeking exposure to the blockchain industry without directly holding cryptocurrencies, blockchain ETFs present an attractive option. These ETFs allow investors to tap into the technology behind cryptocurrencies, potentially benefiting from its growth and adoption. When considering top blockchain ETFs, it’s crucial to evaluate their composition, fees, and performance.

The evolving regulatory landscape for cryptocurrencies in 2025 is another critical factor that might impact investors. As regulations become clearer, they could either bolster or hinder the growth of cryptocurrency investments. Therefore, staying informed about regulatory changes is vital for investors in this space.

To navigate the volatility of the cryptocurrency market, investors must adopt a well-thought-out risk management strategy. This includes secure storage solutions, using reputable exchanges, and diversifying investments. By doing so, investors can mitigate some of the risks associated with cryptocurrency investments.

In conclusion, cryptocurrency and digital assets can be a valuable addition to a diversified portfolio, offering new avenues for growth and income generation. However, it’s essential for investors to approach this asset class with caution, understanding the risks and potential returns involved. By doing thorough research and adopting a prudent investment strategy, investors can harness the potential of cryptocurrency investments.

Arts and Collectibles: Passion Investments with Potential

Diversifying one’s portfolio with arts and collectibles can be a savvy move, combining beauty with potential long-term value. This unique investment avenue allows investors to own tangible assets that have historically appreciated over time.

For those interested in investing in fine art, understanding the market trends and the artist’s reputation is crucial. The value of a piece can significantly increase if it’s created by a renowned artist or has historical significance.

Fine Art and Antiques

Fine art and antiques are sought after for their beauty and potential to appreciate in value over time. When considering this type of investments, factors such as authenticity, provenance, and condition play a critical role in determining the price.

Wine and Whiskey

The market for collectible wines and aged whiskey has seen significant growth as investors recognize their potential for appreciation. Limited-edition bottles and rare vintages can command high returns if stored properly.

Luxury Goods and Memorabilia

Luxury goods and rare memorabilia, such as signed sports items or historical artifacts, have consistently appreciated in value. These unique investments can offer substantial returns for those willing to hold them over time.

In conclusion, arts and collectibles can be a valuable addition to a diversified portfolio, offering a mix of personal enjoyment and potential long-term financial returns. However, it’s essential for investors to approach these investments with knowledge and patience.

Sustainable and Impact Investing Beyond Stocks

Sustainable investing is no longer a niche market; it’s becoming a mainstream phenomenon, driven by investors seeking both returns and positive impact.

As investors seek to align their portfolios with ethical and responsible values, investing in sustainable options ensures a regular return while leading to a positive impact on society and the environment.

Green Bonds: Financing Environmental Solutions

Green bonds are fixed-income securities issued to fund environmentally friendly projects, such as renewable energy and sustainable infrastructure. These bonds offer investors a regular return while supporting eco-friendly initiatives.

By investing in green bonds, investors can contribute to a more sustainable future while diversifying their investments.

Sustainable ETFs: Values-Aligned Growth

Sustainable ETFs focus on companies that meet Environmental, Social, and Governance (ESG) criteria, screening for businesses committed to ethical practices and environmental sustainability.

These ETFs allow investors to support companies that prioritize ESG factors, potentially leading to long-term value creation.

Impact Investments: Profit with Purpose

Impact investing directs capital towards businesses and projects addressing global challenges like clean energy, education, and healthcare, aiming to generate both financial returns and measurable social or environmental benefits.

By allocating investments to impact initiatives, investors can drive positive change while potentially earning competitive returns through various funds.

Alternative Investment Platforms Making Access Easier

The democratization of alternative investments is being driven by innovative platforms. These platforms are making it possible for a wider range of investors to access investment opportunities that were previously reserved for institutional investors or the ultra-wealthy.

Diversified Alternative Investments with Mintos

Mintos offers a range of alternative investment options, including Loans, Bonds, Passive Real Estate, and Smart Cash. Investors can earn regular interest payments, diversify across sectors and regions, and benefit from fee-free investing on certain products. With a minimum investment requirement that is accessible to many, Mintos makes it easier for individuals to start diversifying their portfolios.

Loans: Earn regular interest payments and diversify across various sectors and regions.

Bonds: Invest from €50 and earn fixed returns with fee-free investing.

Passive Real Estate: Generate monthly rental income from property-backed investments.

Smart Cash: Access a AAA-rated money market fund with higher interest than traditional savings and same-day withdrawals.

Access to Previously Exclusive Opportunities with YieldStreet

YieldStreet provides access to alternative investments that were previously only available to institutional investors or the ultra-wealthy. The platform offers a range of investment opportunities, including art finance, real estate, and legal finance. By investing through YieldStreet, individuals can diversify their portfolios with alternative assets that have the potential for strong returns.

Art Finance: Invest in art-backed loans and diversify your portfolio.

Real Estate: Access real estate investments that were previously out of reach.

Legal Finance: Invest in legal finance opportunities with potential for strong returns.

Fractional Alternative Investments with Public

Public allows investors to purchase fractional shares of alternative investments, making it possible to invest in high-value assets with much smaller amounts of capital. This democratizes access to alternative investments, enabling a broader range of investors to diversify their portfolios.

Fractional Shares: Invest in high-value assets with smaller amounts of capital.

Diversification: Spread your investments across various asset classes.

When evaluating alternative investment platforms, it’s essential to consider factors such as fees, minimum investment requirements, and the underlying investments. By doing so, investors can make informed decisions that align with their financial goals and risk tolerance.

Building Your Diversified Portfolio for 2025 and Beyond

As we look towards 2025 and beyond, building a diversified investment portfolio is crucial for long-term financial success. Investors must consider a mix of traditional and alternative investments to manage risk and maximize returns.

Asset allocation is a key component of a diversified portfolio. Investors should consider their risk tolerance, financial goals, and time horizon when determining their asset allocation strategy. For example, conservative investors may allocate a larger portion of their portfolio to bonds and other fixed-income securities, while aggressive investors may favor stocks and alternative investments such as real estate or cryptocurrencies.

When incorporating alternative investments into an existing portfolio, it’s essential to start with small allocations and conduct thorough research. Regular portfolio rebalancing is also crucial to maintain the desired asset allocation as different investments perform differently over time.

Investors should be aware of common pitfalls, such as chasing performance, overcomplicating their portfolios, or neglecting to consider correlation between seemingly different investments. By avoiding these mistakes and maintaining a well-diversified portfolio, investors can better navigate the complexities of the market and achieve their long-term financial goals.

Ultimately, successful investing is a personal journey that should align with individual goals, risk tolerance, and values. By using the information in this article as a starting point and staying informed about market trends, investors can create a tailored investment strategy that meets their unique needs.